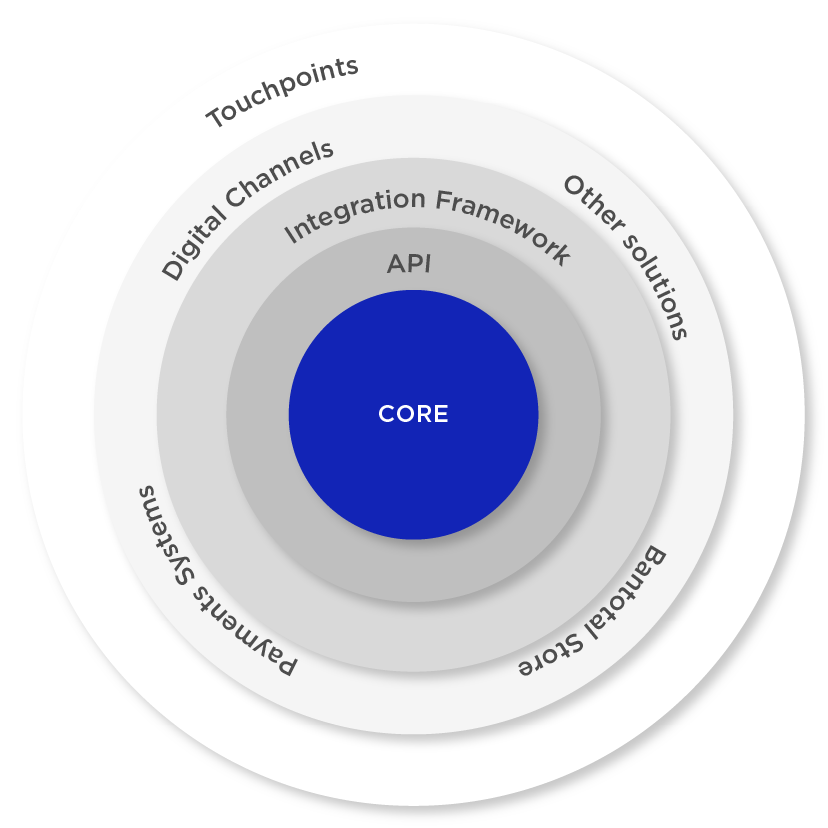

El ecosistema tecnológico que toda entidad financiera necesita para evolucionar rápidamente

Bantotal core bancario es la plataforma tecnológica que resuelve de forma simple, completa y precisa, los procesos financieros de alta trascendencia para bancos, financieras, Fintech, bancos digitales, canales digitales, proveedores de banca, entre otros.

Como nivel I dentro de la arquitectura funcional, Bantotal está en la capacidad de responder por la contabilidad en línea, en tiempo real, de forma automática y con control de la partida doble. El saldo operativo y el saldo contable se resuelve en el mismo proceso, por lo tanto, no requiere la presencia de auxiliares contables.

Los módulos operativos utilizan los mismos componentes del núcleo, por lo tanto, están integrados naturalmente, sin requerir interfaces que permitan la operación entre ellos.

Resuelve la operativa bancaria y la contabilidad, conservando la seguridad en cada transacción y el cumplimiento normativo.

Reduce el time-to-market, automatizando procesos con practicidad y facilitando la integración con otros sistemas.

Al soportar altos volúmenes de transacciones, operando 24x7 gracias a su infraestructura flexible y de respuesta rápida.

+75 Instituciones Financieras en 15 países probaron su eficiencia

Es multiplataforma a nivel funcional y tecnológico

Escala según el aceleramiento del mercado financiero

¿Por qué Bantotal es diferente a otras soluciones financieras?

Es una plataforma bancaria centrada en el cliente, la cual fija un punto de partida en sus expectativas y luego identifica los elementos necesarios para satisfacerlas de forma rentable.

Gestiona el procesamiento integral de toda la actividad de una Institución Financiera, minimizando la cantidad de interfaces y disminuyendo la cantidad de proveedores.

Utiliza un solo dato y múltiples visiones, evitando la necesidad de realizar conciliaciones entre el inventario de productos y la contabilidad.

Dispone de información en línea y en tiempo real, incluyendo la contabilidad para agilizar trámites.

Es seguro ante cambios regulatorios, soportando la normativa requerida por los diferentes Organismos Reguladores.

Acelera el “Time-to-market” del negocio, mediante soluciones y funcionalidades altamente parametrizables.

Disminuye el costo operativo, automatizando un porcentaje de los requerimientos operativos y eliminando los costos en los controles de integración.

Descubre cómo nuestro core financiero puede impulsar tu negocio

Déjanos tus datos y en breve nos comunicaremos para asesorarte.

¿Dónde podrás aplicar Bantotal Core Bancario con total éxito?

Bantotal BPeople es una nueva visión 360° de atención al cliente mediante un software core bancario que revoluciona la forma en que las personas interactúan con su banco.

La digitalización agiliza y facilita la relación con los clientes, logrando que la experiencia de usuario sea más agradable en lo conocido como Home Banking (personas/empresas).

La innovación tecnológica de Bantotal son su solución de banca online ha impactado en todos los campos financieros, logrando que, a través de distintos canales digitales, el cliente pueda elegir cómo realizar sus operaciones diarias, alcanzando la transparencia que requiere cualquier tipo de transacción bancaria.

Bantotal BPeople es el sistema core bancario que disminuye costos operativos en las sucursales de los bancos, mediante propuestas de valor contempladas según las necesidades de los clientes.

BPeople mejora la comunicación con sus clientes, estableciendo nuevos canales de comunicación. Por estas y otras razones es una opción tecnológica imprescindible:

Resuelve tus dudas sobre Bantotal Core Bancario

Bantotal es la elección ideal para instituciones financieras que buscan transformar sus operaciones con tecnología avanzada. Entendemos que puede haber dudas antes de dar el siguiente paso, por eso queremos resolverlas.

¡Es el momento de impulsar tu entidad financiera hacia el éxito!

Bantotal Core Bancario es una plataforma tecnológica que simplifica y optimiza los procesos financieros de alta trascendencia para bancos, financieras, fintech, y proveedores de banca. Su capacidad de contabilidad en línea y en tiempo real, junto con la integración de módulos operativos, garantiza una operativa eficiente y segura sin la necesidad de interfaces adicionales.

La integración de nuevos miembros es rápida y económica, ya que Bantotal elimina la necesidad de procesos administrativos complicados. Esto permite reducir demoras y mantener el foco en los negocios, resultando en un ahorro de costos significativo.

Bantotal asegura que cada transacción se realice con total seguridad y cumpla con la normativa requerida por los organismos reguladores. Además, su capacidad de adaptación a cambios regulatorios garantiza que tu entidad financiera siempre esté en cumplimiento.

Bantotal BPeople ofrecen una plataforma unificada para la gestión de productos y servicios bancarios. Esto permite realizar transacciones desde cualquier dispositivo con conexión a internet, mejorando la comunicación y la experiencia del usuario en la banca en linea.

Bantotal BPeople proporciona una visión 360° de atención al cliente con un software core bancario innovador. Ofrece una plataforma única y personalizada para gestionar soluciones financieras desde cualquier dispositivo con conexión a internet. Disponible 24/7, permite escalabilidad en la venta de productos y servicios, y integra sistemas de gestión para asegurar robustez y seguridad.